Understanding Voi's Q1 2025 Financials

Full breakdown of Voi Technology's Q1 2025 financials

Welcome to Micromobility Pro, a bi-weekly publication which is part of The Micromobility Newsletter, where we deep-dive into financials of micromobility companies and exclusive insights tailored for professionals and members.

Today’s newsletter is brought to you by… S-E-A

S-E-A’s dynamometer products can test the full suite of your micromobility products – and your competitors’ products too! From end-of-line testing to industry benchmarking, the new Modular Dynamometer can meet your e-bike and scooter evaluation needs today.

🚨 Micromobility Europe is less than a month away and this year’s speaker lineup is one of our strongest yet!

We’re hosting three exclusive fireside chats, and here’s a highlight you won’t want to miss:

🎤 Robin Wauters, Founder of tech.eu will sit down with Fredrik Hjelm, Co-Founder & CEO of Voi Technology, for a candid conversation about Voi’s journey, lessons learned, and what’s next in shared mobility.

Did you get your tickets yet? Use the code NEWSLETTER to get an additional €100 discount.

ps: if you’re a member or annual subscriber, do drop a message to hello@micromobility.io to get your 25% discount code.

Contents

About Voi

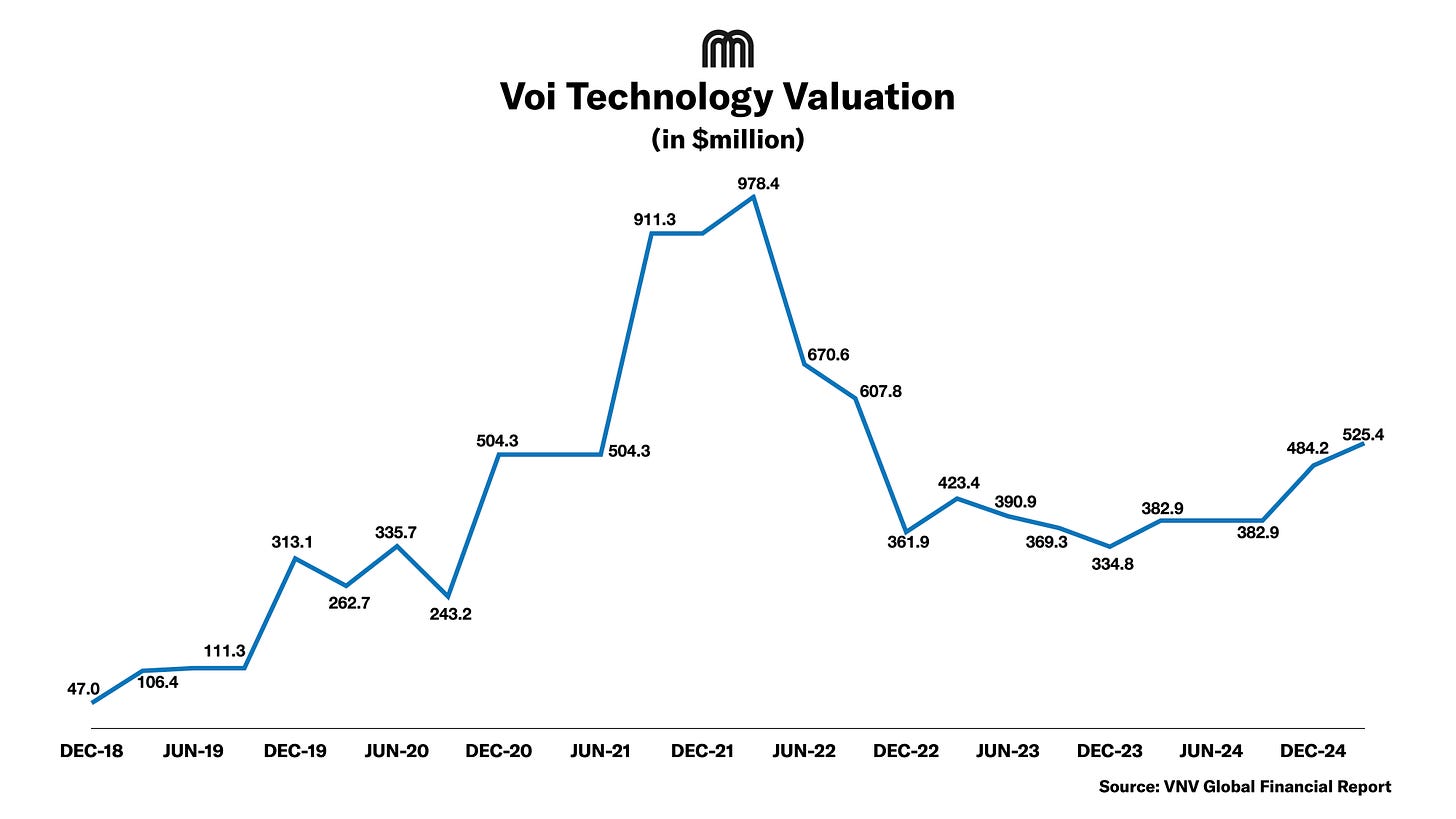

Chart: Voi’s Quarterly Valuation (2018-2025)

Q1 2025 Financial Performance

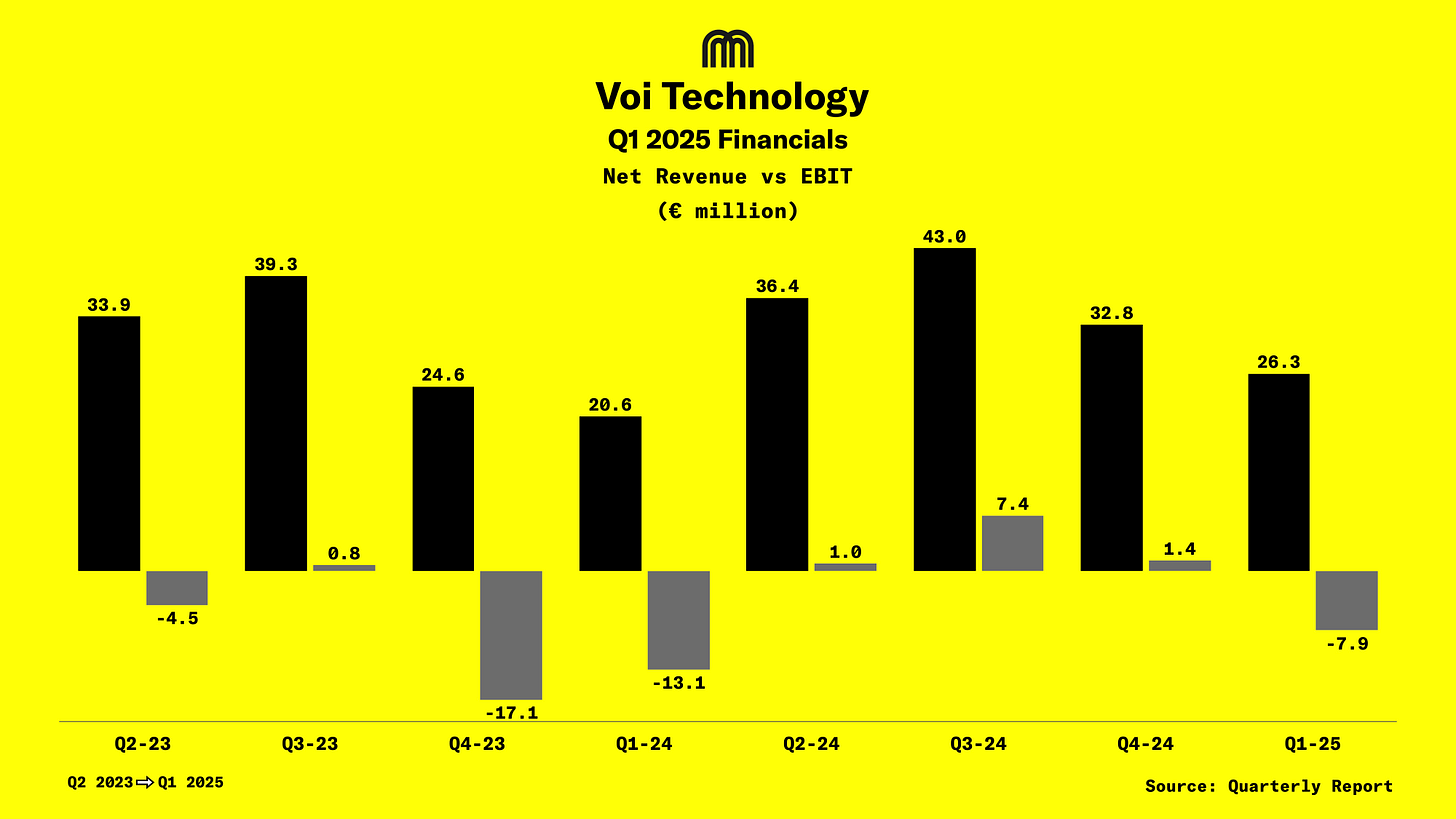

Chart: Quarterly Revenue vs EBIT (2023-2025)

Chart: Quarterly Trips vs Vehicles Deployed (2023-2025)

Chart: Quarterly TVD and RVD (2023-2025)

Revenue Breakdown

Chart: Revenue Breakdown by Category and Geography

Cost Structure

Chart: Quarterly Vehicle Profit Margin, Market EBITDA %, EBIT % (2023-2025)

P&L Shapshot

Cash Position & Balance Sheet

Consolidated Balance Sheet

2025 Outlook

Conclusion

About VOI

Voi Technology is a Stockholm-based shared micromobility company founded in 2018. The company operates a dockless, app-based e-scooter and e-bike sharing platform across more than 110 cities in Europe.

Voi has raised ~$595m so far according to crunchbase and Voi’s investor VNV Global has markedup their valuation by 8.5% from $484.2m in Q4 2024 to $525.4m in Q1 2025.

Q1 2025 Financial Performance

Voi reported revenue of €26.3m in Q1 2025, marking 28% year-over-year growth from €20.6 million in the same quarter last year. Growth was fueled by an 18% increase in deployed vehicles and stronger ride frequency across core markets.

Utilization rose to 1.93 trips per vehicle per day (up from 1.62), while net revenue per vehicle per day improved to €3.17, up 10% year-over-year.