Another Record Year for SWING - $44.5M Revenue and Profitable

[Micromobility Pro] Swing closes 2024 with $44.5M in revenue, continued profitability, and bold moves into new business verticals despite rising costs and debt.

Welcome to Micromobility Pro, a bi-weekly publication which is part of The Micromobility Newsletter, where we deep-dive into the financials of micromobility companies and share exclusive insights tailored for professionals and members.

Join the leaders in micromobility. Get an annual subscription today to access the members-only Slack, event ticket discounts, and the full Micromobility Pro content library.

Showcase Your Brand at Micromobility America – Jan 14–15, 2026, San Francisco

Join the leading event for small electric vehicles, shared mobility, and retail opportunities in the US market.

Exhibiting and sponsorship packages put your products in front of industry leaders, innovators, and decision-makers with year-round visibility across the world’s largest micromobility media network.

Early Bird rates end on September 1st - secure your spot now!

Book a Meeting or Fill out the interest form

🎤 Want to speak? Apply here

🎟 Super Early Bird Tickets - Just $1500 $249

Very few tickets left at this price - prices rise once these sell out.

Contents

About Swing

Ownership Structure

2024 Financial Performance

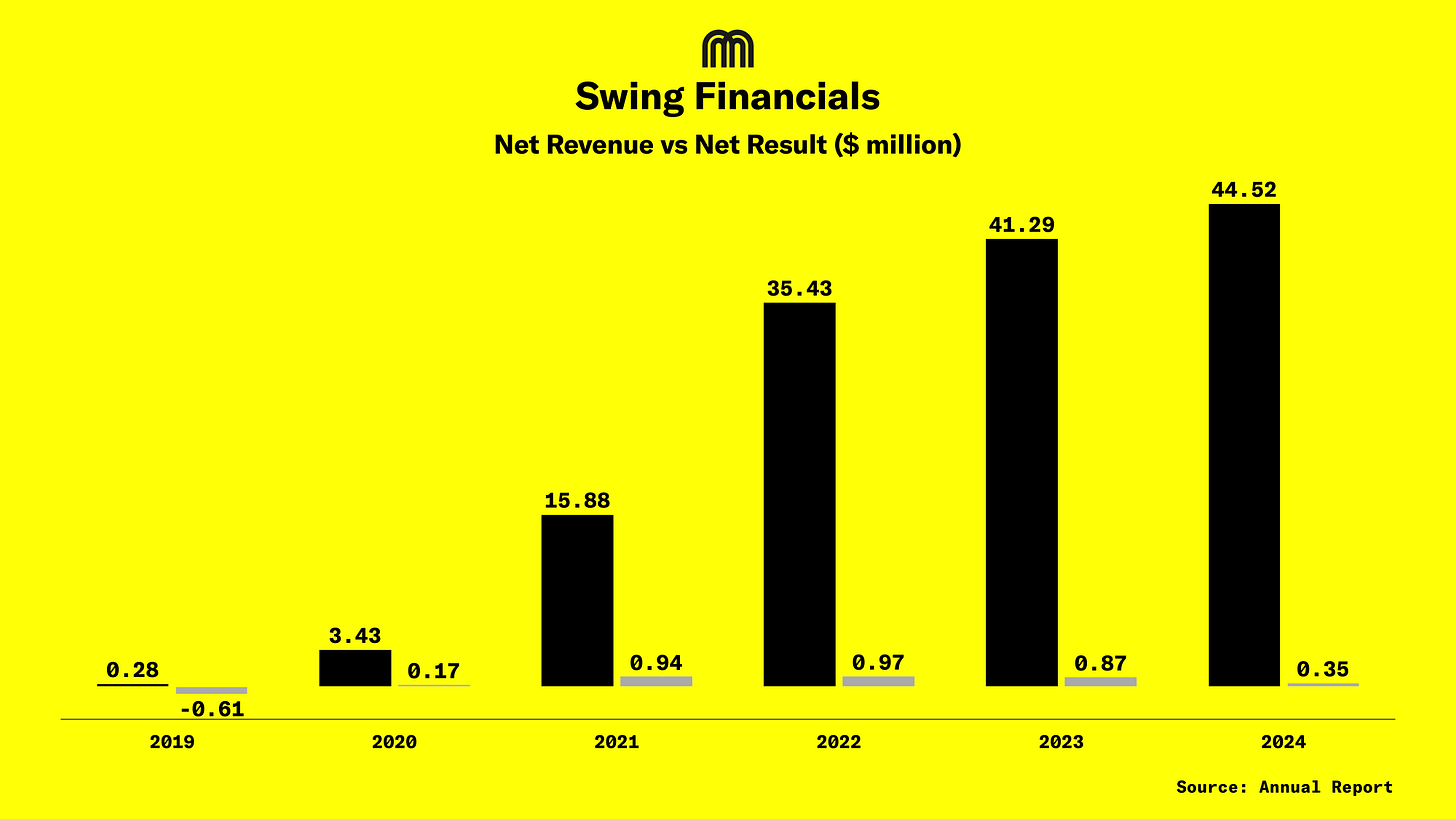

Chart: Net Revenue vs Net Result ( 2019 to 2024)

Revenue Breakdown

Chart: Revenue Split by Geography and Category

Cost Structure

Chart: Cost Breakdown

Table: P&L Snapshot

Cash Position & Balance Sheet

Balance Sheet Snapshot

Strengths & Challenges

Major Developments (2022–2025)

2025 Outlook

Conclusion

About Swing

Swing Co., Ltd. is a South Korean micromobility company operating shared bicycles, scooters, motorcycles, and kickboards through an integrated online platform. Beyond rentals, Swing develops proprietary fleet management software, licenses mobility technology, and offers insurance products tailored to shared mobility.

The company operates in both domestic and overseas markets, notably Japan through its subsidiary Swing Japan.

Checkout this panel from Micromobility Europe 2024, moderated by Micromobility Industries CEO Prabin Joel Jones, where Swing’s founder San spoke about how Swing has remained profitable

Ownership Structure

As of 31 December 2024, CEO Kim Hyeong-san and affiliated entities own 26.17% of the company. Other major investors include Hashed Ventures (15.69%) and White Star Capital (10.34%). Swing has 52,786 issued shares, comprising 18,817 common and 33,969 preferred shares.

Swing has issued two types of convertible preferred shares:

Type 1: 3,227 shares at $250 each, total $0.81M

Type 2: 11,712 shares at $228 each, total $2.66M

Both mature 10 years after issuance.

2024 Financial Performance

Swing closed 2024 with revenue of $44.5M, up 12.5% from 2023. However, profitability weakened sharply: operating profit fell nearly 70% to $1.1M, while net income declined 58% to $0.35M.

Gross margin compressed to 23.1% from 29.2%, reflecting higher fleet maintenance, depreciation, and financing costs. The company ended the year with a debt-to-equity ratio of 124%, up from 77% in 2023.