€3.3M EBIT on €16.8M Revenue: Nextbike Polska’s Turnaround in 2024

Full breakdown of Nextbike Polska's 2024 financials with historic charts and P&L

Welcome to Micromobility Pro, a bi-weekly publication which is part of The Micromobility Newsletter, where we deep-dive into financials of micromobility companies and exclusive insights tailored for professionals and members.

Micromobility Pro yearly subscribers get access to Members only slack and discounts on event tickets.

🚨 €1000 Off Sale Ends Tonight (CET) - Last Chance to Get Tickets at €500!

Buy more to get more discount: 1–2 for €500 each, 3–4 for €450 each, 5–6 for €400 each, 7–8 for €350 each, 9 for €300 each, 10 or more for €250 each.

Check Micromobility Europe 2025 Speaker lineup here

Get Involved: Sponsor/Exhibit or Speak at the Event.

Are you a Startup? Join our exclusive Startup Arena - Two event tickets, an exhibition space and access to networking app for selected startups. Apply now!

If you are a City Official, Student, Journalist or Researcher - Apply here for a free pass!

Contents

About Nextbike Polska

2024 Financial Performance

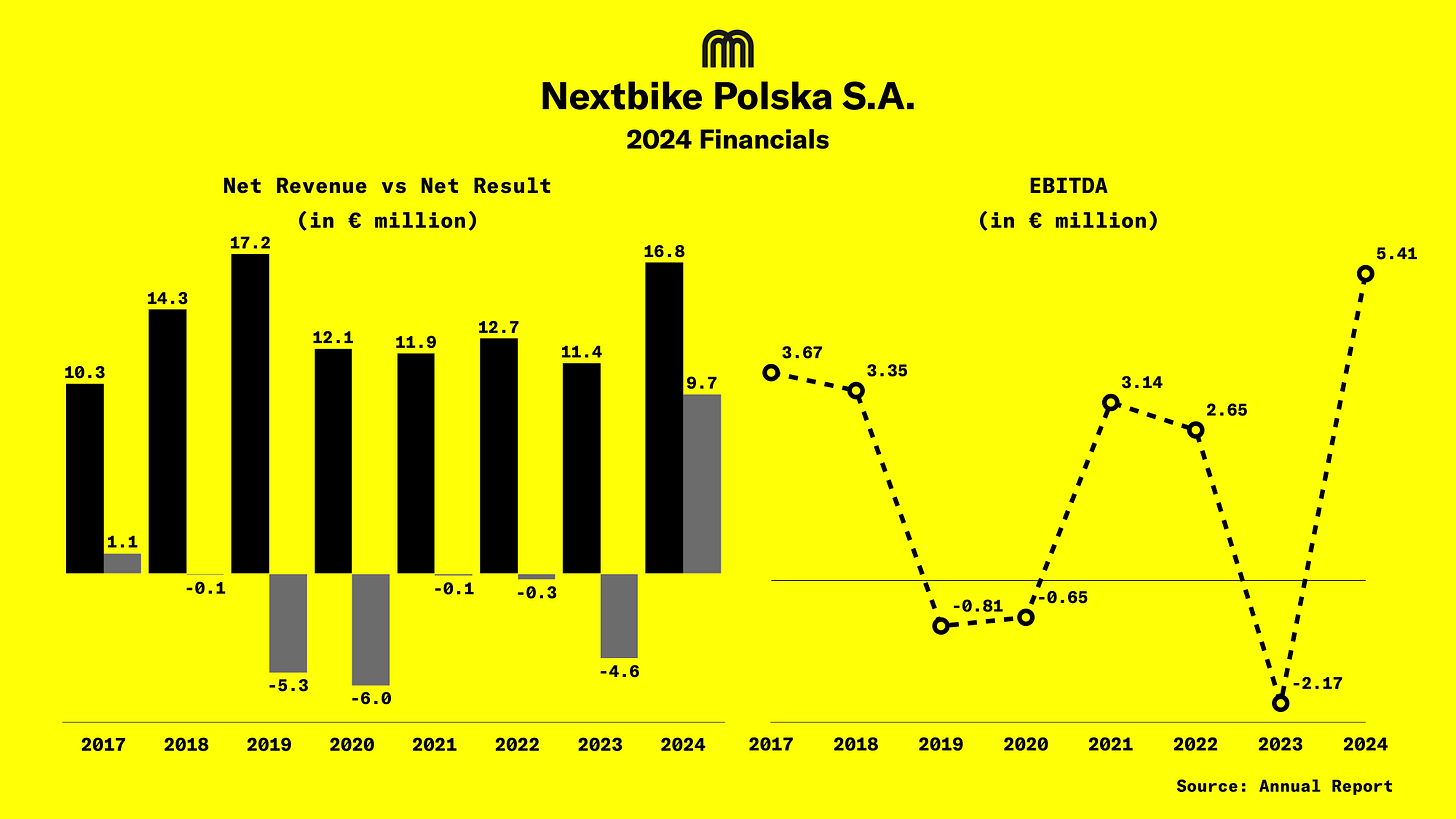

Chart: Revenue vs Net Profit and EBITDA (2017 - 2024)

Revenue Breakdown

P&L Snapshot

Cost Structure

Chart: G&A as a % of Revenue (2017-2024)

Cash Flow & Balance Sheet

Stock Performance

Conclusion

About Nextbike Polska

Nextbike Polska SA, operating under "Nextbike Polska SA w restrukturyzacji" since June 2020, is a Warsaw-based joint-stock company providing and managing self-service public bike systems. Established in 2010 and listed on NewConnect since 2017, it partners with local governments across Poland and offers private services like advertising and sponsor stations.

Ownership has shifted over time, from Germany’s Nextbike GmbH to Tier Mobility SE in 2023, and most recently to STAR Pedal II GmbH in 2025. Several fully owned Polish subsidiaries are consolidated into its financial reports.

2024 Financial Performance

Nextbike Polska returned to profitability in 2024, reporting a net profit of €9.7m, a sharp reversal from a €4.6m loss in 2023, an improvement of €14.3m year-over-year.

Revenue rose by 47%, from €11.4m to €16.8m.

EBIT turned positive at €3.3m, up from a loss in 2023.

EBITDA jumped to €5.4m, compared to a €2.2m loss the year before.

Gross profit grew by 162.5%, from €2.4m to €6.3m.

Earnings per share improved from -€2.7 to €2.8.

This financial turnaround was supported by cost controls and a €6.1m debt reduction through restructuring.